By: Paul HO Kang Sang

Specially written for Singapore Citizens as well as Singapore based Expatriates.

FUNDS AND EMPTY PROMISES

Many professional fund managers promise you 10%, 15% or even 20%. Sometimes you are even tempted to buy into a theme. There is always something sexier (in terms of investment) out there. However, most funds usually tout the theme with the highest investors (punters) mind share. Such as those that are obvious or those that are already heavily exposed to the media or those funds/themes that had already shown stellar results. Of course it is easy to sell things that everyone are already familiar with. What more, with funds/themes that have a track record already.

As the funds or the segment in focus tracks higher and higher, usually it attracts a strong following. These people bring along with them irrational euphorism (borrowing the term from Mr. Alan Greenspan), leading the stocks higher. These stock prices tend to go higher faster than their economic fundamentals can follow. Thereby exposing the ordinary investor with HUGE downside risks.

LOSING YOUR PANTS

The analogy is simple. Let’s say we throw a TEN-SIDED dice. The last time we threw an 8 (Assuming 8 is the price we bought it at). And assuming if we throw a 9 or 10, we make 1 dollar and 2 dollars respectively. But if the dice is a fair dice, the average expected dice throw (of 1,2,3,4,5,6,7,8,9,10) is 5.5. Therefore the probability that the throw is 5.5 is quite high.

Let’s look at it in terms of downside risks. If you threw an 8. If the next throw is 5.5, you lost 8-5.5 = 2.5 dollars. If the next throw is 10, you only gain 10-8= 2 dollars. But if the next throw is 1, you lost 8 -1 = 7 dollars.

In other words, you are buying into something that gives you consistently upside (max) of +2 dollars while the downside of -7 dollars. The average downside is -2.5 dollars. In other words, each one of these trades you will lost -2.5 dollars. If you bought 1000 shares of bet, you would then lose -2500 dollars. And assuming you bought 5 bets a year, you would (lose) -12,500 dollars a year. How will you know it’s an 8 and not a 1??? Well, the people and the market always tell you, this time it’s different. This time it’s a fundamental shift and a new paradigm. Take a look back at news articles up to 10 years in time. Take a look at what brokers, analysts and fund houses were saying when Straits times Index (STI) was at 3700 points, didn’t they say it will breach 4000 points?

Losing money with each bet is what I call FOOLISH. Just like going to casino, you can win short term, but if you play a large number of times, statistically bets revert to a mean score, i.e. which is, on every game, you lose money. This is called the “house margin” in casino speak. Unless you are playing for fun, same as bowling or any sports or games, you while away your time and you are happy to pay doing that. That's fine.

I enjoy making money and having fun. I like statistical high probability but I like close to 100% certainty even more.

PUNTER’S BEHAVIOUR

Most punters behaviour are characterized by GREED and FEAR.

• Greed when the market is rising. (BUY at HIGHEST)

• Hope when the market is dropping or starting to drop, and (HANG ON while dropping)

• Extreme fear when the market is at it’s lowest. (Therefore punters SELL at Lowest)

I fall into these traps from time to time, but as I constantly remind myself, I tend to fall into it a little less often.

Despite shares being the best investment asset classes from empirical studies, averaging in the 10-12% range, most punters only make less than 5% returns or worse, negative returns. Because they let GREED and FEAR get in their way. Actually this is a trap for most ordinary investors.

BENEFITS OF CERTAINTY

Things with certainty are: -

• Cost reduction. (Every dollar saved is every dollar earned, SIMPLE MATHS)

• Tax efficiency

RISKS AND LIMITATIONS

The risks of putting money in SRS are mainly related to Singapore dollar currency risks and policy risks. Singapore's equity market is still considered shallow in depth and the total market capitalization of companies listed in Singapore are still small. The investment is also not as liquid and carries a 5% penalty on early withdrawal and the withdrawal amount counts as income earned and is taxable at the sliding income tax rate.

The key inadequacies are the limited investment opportunity set, although SRS claims that they do not regulate where you can invest, however the 3 local banks allowed to operate SRS will NOT let you invest the money outside of Singapore, i.e. NYSE, Nasdaq, HKSE, etc. This severely limits the investment opportunity set.

There are some doubts as to whether these limitations are a broader policy strategy from the Singapore Government to keep the liquidity in the country or whether it is purely a bank administrative cost-benefit equation. This is considering that 2 of the 3 banks are heavily government involved/influenced and the 3rd bank UOB is believed to toe the line on government unspoken policies and broader strategic plans.

THE SUPPLEMENTARY RETIREMENT SCHEME (SRS)

(Ministry of Finance, Singapore, http://www.mof.gov.sg/taxation/srs.html)

Supplemental Retirement Scheme (SRS) is one such program. Any tax relief is money earned!!! (You can’t get more certain than that, that is 100% guaranteed)

As long as you are a tax payer, there are potential benefits to be had, of course there are certain short-falls as well which I will also mention.

Take a look at the TAX BRACKET above.

CASE STUDY: Taxable income of 100,000 SGD.

The first S$80,000 is taxed at S$4,300

The next S$20,000 is taxed at 14%, i.e. S$2,800

Total Tax = S$7,100

As you notice, the contribution cap is not the same, this puts the Singapore citizen at a disadvantage.

• For a Singapore citizen, he/she is eligible to invest/contribute up to a maximum of S$11,475 (15% x 17 x S$4,500).

• If you are a foreigner, your SRS contribution cap is S$26,775 (35% x 17 x S$4,500).

As SRS is tax deductible. If you contribute: -

S$11,475 → Taxable income becomes S$100,000 – S$11,475 = S$88,525.

The taxable income becomes S$4,300 (1st S$80,000 income) and

14% of S$8,525 = S$1,193.5 = S$5,493.50.

Tax Savings = S$1,606.50 (or 14% RETURNS outright almost IMMEDIATE)

If S$26,775 → Taxable income becomes S$100,000 – S$26,775 = S$73,225.

The taxable income becomes S$900 (1st S$40,000 income) and

8.5% of S$33,225 = S$2,824. = S$3,724.

Tax savings = S$7,100 – S$3,724 = S$3,376 (or 12.61% outright almost IMMEDIATE)

INVESTING THE SRS MONEY

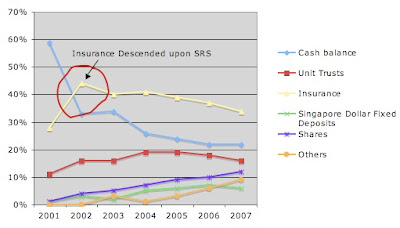

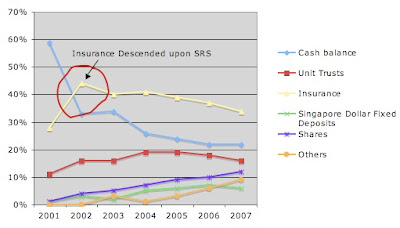

Insurance professionals descended onto SRS like bees to honey. Banks alike, they are keen to peddle their products. They are not keen to tell you about SRS. Also, if the banks have to tell you about SRS or if you asked about SRS and If you have money to put aside outright, they WANT YOU. They want you to buy FUNDS, Insurance and Trusts, etc. As has happened with Insurance on SRS.

If you already have an SRS account or is determined to have an account, most vested interest groups are eager to give the impression that it’s for insurance needs and for investing in funds, I suspect, from whichever gives them the most commission. From the second year of SRS’s existence, insurance pounded onto SRS monies. Apparently they were successful as the awareness was low. Over the subsequent years, insurance as a percentage of SRS total funds usage dropped back gradually, in my personal opinion, thankfully.

In fact, most SRS investors are still (just my opinion) not very sophisticated as can be seen by the high levels of CASH holdings of 22% and Insurance at 34% and Singapore Dollar Fixed Deposits of 6%. Shares only take up 12% of all SRS monies.

From the breakdown of the funds used in SRS, I would say most people who did SRS did not fully benefit from the secrets of this scheme but instead ended up buying some form of financial products. If they understood what they got into, fine, if not, it's sad. It surely seems that they do NOT understand. But the outlook is positive, more and more people seemed to be taking charge of their investments as “others” and Shares have been on the increase.

(Chart adapted from Ministry of Finance, Singapore, SRS Statistics)

BUYING SHARES WITH SRS

However there are a lot of companies such as utilities, rail or REITS which have high asset backing (a low Price/Book ratio) and gives consistent dividends of between 5 to 10% with some additional capital gains.

“SRS investment returns are accumulated tax-free (with the exception of Singapore dividends from which tax is deducted or deductible by the payer company under section 44 of the income Tax Act)” (Finatiq, http://www.finatiq.com/helpcentre/Hcr_Basics_SRS.shtm

). And only 50% of the withdrawals from SRS are taxable at retirement.

Say your returns are 5% (capital gains) and your dividends are 5% (after company tax, @ around 20% company tax, you would get ~4% dividends. Your total untaxed returns are 9%.

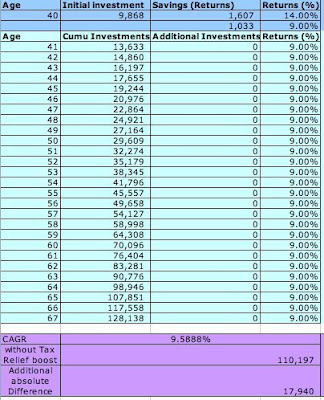

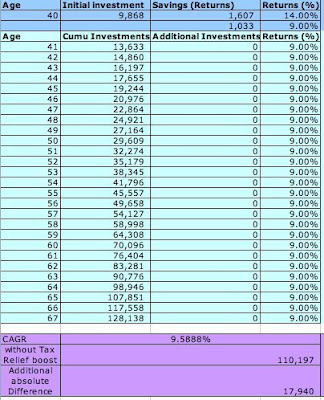

Let’s say you are now 40 years old and retirement age is 67 years old. Therefore you have 28 years of investment horizon.

(Source: Ministry of Finance, Singapore, http://www.mof.gov.sg/taxation/cumulative.html)

COMPUTING THE RETURNS OF SRS INVESTMENTS

Since the LUMP sum is given to you as a "TAX relief", you invested S$11,475, but actually you only paid S$9868.5. You deposit the money in Latest December the year prior, the tax returns are filed in April the next year, while the tax assessments are out in July or August. Therefore, by 6-7 months’ time, you will get your 14% returns or 12.61% returns (if you are a foreigner) If you have 14% tax savings + 9% returns on 11475, that will give you S$1032.75. (Note: the returns are simply my rough estimates) During this time, the money can already be put to use in the SRS account.

At S$9868 dollars over 28 years at 9% each year, the returns would have been $110,197 or S$17,940 lesser.

That initial boost in returns gives you an extra 0.59% per year over 28 years. Your overall portfolio is only expected to be around 14% better, but in dollar quantum that is S$17,940 better. For our foreign friends, the quantum is S$37,700 better.

In other words, this SRS Scheme allows you to compound your TAX SAVINGS while only paying tax on the initial amount many years later. Considering inflation and returns that you could have made over the years before you have to pay TAX, the tax ends up being CLOSE TO NOTHING.

TAX ON WITHDRAWAL AT 67 YEARS OF AGE

At 67 years old, if I withdraw all S$128,138 (Capital gains are NOT taxable, though dividends are taxable, but they are already taxed at source), but only S$9,868 dollars is considered as SRS initial contributed amount, of this only 50% of this is taxable, I.e. S$4,934 is taxable.

• Taxable SRS withdrawal = 50% of S$9,868 = S$4,934

Assuming same tax rate, income at 67 years old = S$100,000. With an additional S$4,934 taxable income, I incur extra tax of 14% of S$4,934 = S$690.76

This S$690.76 can easily pay out of my additional returns of S$17,940. The nett gain is still S$17,249

DILIGENT SAVER & INVESTOR

Now, if you consistently contribute year on year into SRS, you would get that additional boost of returns each year (in the form of tax relief) thereby compounding your returns even more.

I am not against making fast money, it is just that I don't know how. If you know of something please LET ME KNOW, I'm open to it, let's share. All I know now is that if you consistently make high probability calculated bets, you have a high chance of winning and if you make almost certain bets with almost NO RISK, then you almost surely will win. It's just that it is very slow. Over time, you will see many many opportunities, but always grab those with high certainties. RULE Number 1: Never lose money. Rule number 2: always refer to rule number 1.

The writer: -

Paul Ho is a keen investor but with very little money. Although he does not have a financial license and is not able to make recommendations to individuals, he is happy to help you take a look at your portfolio and give you his personal opinion. Paul currently does it as a hobby helping his friends by giving them his honest opinions on what strategies are good and beneficial for them.

References: -

1. Ministry of Finance, Singapore, http://www.mof.gov.sg/taxation/cumulative.html

2. Finatiq, http://www.finatiq.com/helpcentre/Hcr_Basics_SRS.shtm

3. Dollardex.com, http://www.dollardex.com/sg/index.cfm?current=../contents/srsfaq&contentid=1287

quote: "Success is a thought process"